Having to do a line at your bank is very off-putting. Now, if you’re running the bank you’ll know that having fewer clients is not really a smart way to fix this. Don’t lose hope, you don’t need to lose customers to solve this issue. A good IVR system will let you keep your clients and lose those lines.

Table of Content

What is an IVR system?

Interactive Voice Response systems have been around since 1980, you’re probably familiar with them. It allows callers to navigate through your services using voice recordings, voice recognition, and dial tone inputs. This can save a ton of budget on receptionists. Also, it could save your account holder’s the need to go to the bank. According to Parature, 81% of customers prefer using the phone anyway.

The most common uses for IVR on banks are getting account information, Investment portfolio updates, filling applications, submitting complaints, and finding information about products or services.

Improve trust, reduce call volume, and delight account holders with IVR

How will IVR improve account holder’s experience?

A good IVR system will go a long way to improve your consumer experience. It’s an excellent resource for both your consumers and your executives. Let’s take a look at the specifics.

Get rid of those lines

Being able to get information, and even do simple transactions over the phone can eliminate the need for your consumer to go to the bank. This will be great for the caller, saving them the trip. It will also help your other customers, more people handling their banking over the phone means less annoying lines.

Customized conversations

Your executives will have a better time dealing with your clients if they know what each client is looking for ahead of time. An IVR system will take your clients through your services, giving them all the information automatically. This way you’ll be properly informing your client while saving your executive time.

Make your bank look more professional

Having a proper IVR system in place will show your clients that they are not alone, many people use your bank’s services. It will also show that you appreciate their time, streamlining the process.

Time- and Location-based routing

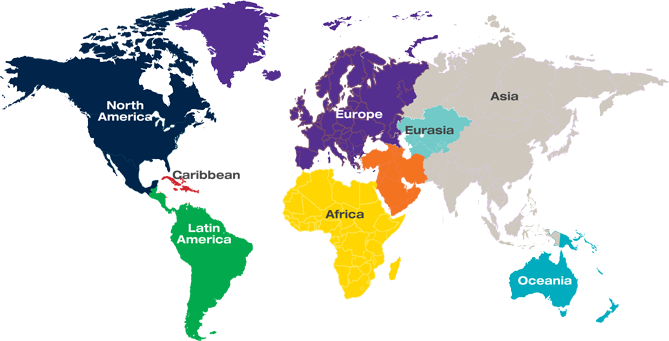

Letting your client know that your bank is closed will save them time and let them know when to call. Now, if you’re dealing with regional or international clients, learning the location they are calling from will give you valuable input. You could customize the available languages, and information available.

Reducing costs

A good IVR Voice Recording will free up your marketing budget. You’ll spend less on receptionists and your executives will be able to meet with more clients. This will allow you to allocate that budget on user experience campaigns.

These are just some of the ways an IVR system will improve the experience of your account holders. Now, if still have doubts about how an IVR system can help your bank schedule a free consultation today, CALL NOW +971-4-454-1054. We are happy to answer your questions.